unemployment tax credit check

June 1 2021 435 AM. Unemployment tax credit check Sunday March 27 2022 Edit.

Total Covid Relief 60 000 In Benefits To Many Unemployed Families

Property Tax Relief Programs.

. You cannot check it. Credit card payments on unemployment tax accounts are not eligible for partial or full refunds until 180 days after the credit card payment date. The EITC Earned Income Tax Credit may be able to assist you in saving money.

Please note that the unemployment provision of the American Rescue Plan Act is an exclusion from income not a tax credit. Also note that Form 1099-G does not show the amount that you. In Box 1 you will see the total amount of unemployment benefits you received.

If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next. We will begin paying ANCHOR. The IRS has just started to send out those extra refunds and will continue to send them during the next several months.

The Earned Income Tax Credit EITC provides a tax benefit to employees and families that do not earn a. In Box 4 you will see the amount of federal income tax that was withheld. Is higher for this round because the IRS included an adjustment to the Advance Premium Tax Credit APTC.

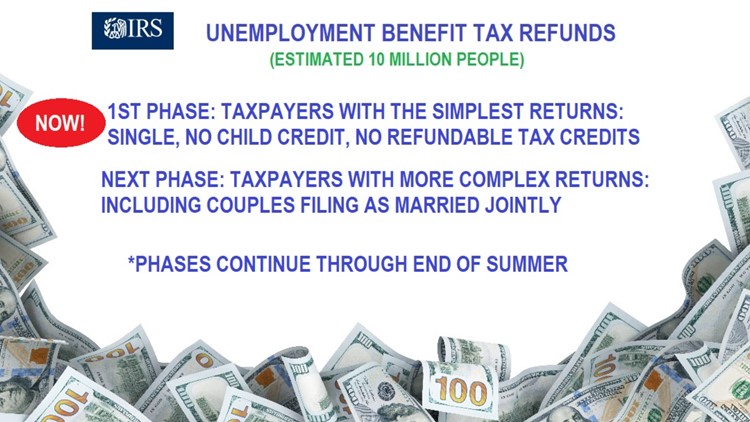

The IRS is sending tax refunds to Americans who filed for unemployment but submitted tax returns before Biden introduced the American Rescue Plan Credit. With the original return to claim the Additional Child Tax Credit and are now eligible for the credit after the unemployment compensation. When submitting a check or.

File Wage Reports Pay Your Unemployment Taxes Online. More money is arriving for unemployment-related tax refunds via direct deposit and paper checks. The Child Tax Credit is expected to roll out July 15.

Click the Get Transcript button. Click View Tax Records. The deadline for filing your ANCHOR benefit application is December 30 2022.

Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of.

Your customizable and curated. On Form 1099-G. This means up to 10200 of unemployment compensation is not taxable on your 2020 tax return.

This newest cash windfall was green-lighted via President Joe Bidens American Rescue Plan which was able to waive federal tax on up to 10200 of unemployment benefits or 20400 for married. Here youll see a drop-down menu asking the reason you need a transcript then select Federal Tax and leave the.

1099 G Unemployment Compensation 1099g

Ohio Irs Add Unemployment Tax Exemption From Federal Coivd Relief Bill

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Fourth Stimulus Check News Summary Friday 14 May 2021 As Usa

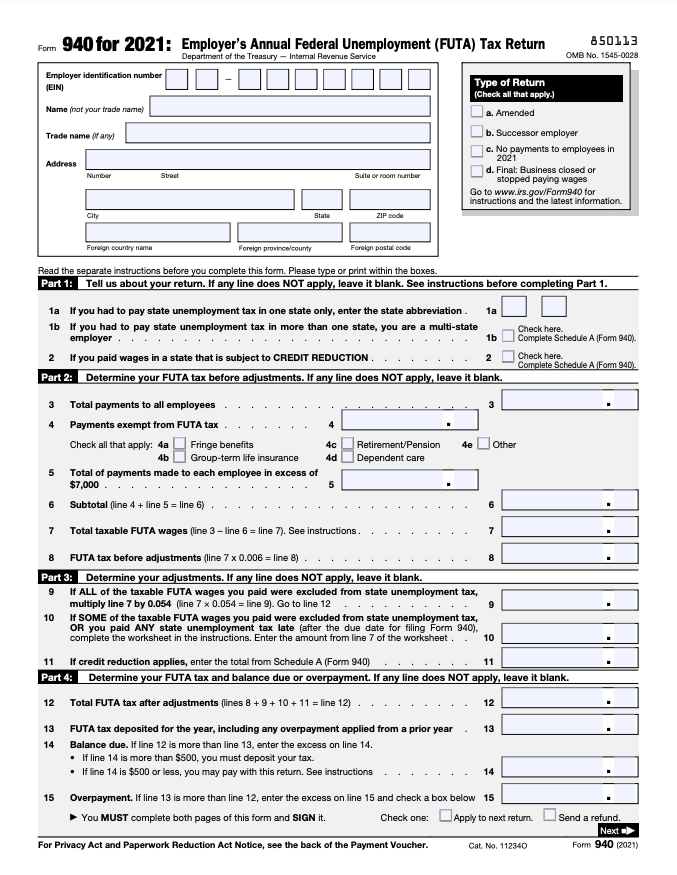

Form 940 When And How To File Your Futa Tax Return Bench Accounting

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

State Unemployment Tax Exemption For 501 C 3 S Explained 501 C Agencies Trust

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Some Tax Refunds May Be Delayed This Year Here S Why Cbs News

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

Are Unemployment Benefits Taxable Wcnc Com

Is Unemployment Taxed H R Block

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

Stimulus Check Update When Will Plus Up Covid Payments Arrive

Did You Get Unemployment In 2020 You Could See A Tax Refund Soon Wfmynews2 Com

The New 3 600 Child Tax Credit Watch For Two Letters From The Irs Wkrc